UPDATED May 30, 2024 to reflect current SBA guidance.

Credit memos are critical to a loan application as they help tell the story of a borrower, their business and how the loan will be used. This story is then evaluated by the bank and the SBA to determine whether the loan will be approved or denied.

Just as any good storyteller does, the lender creating the credit memo must include specific elements that help paint the picture of why the borrower should be approved for a loan. If any of these elements are missing, the story will be incomplete which can lead to the loan being delayed or denied.

Not only can incomplete credit memos lead to frustrations for the borrower, they can in some cases even lead to a repair or denial of the guaranty from the SBA. The SBA has strict criteria for credit memos that are put together for SBA 7(a) loans. These credit memos are heavily scrutinized by the SBA throughout the approval process or in the event of a borrower default.

Streamlining the loan application process starts with understanding what the SBA is looking for in their credit memo standards. Below we highlight some of the most important items to include on SBA credit memos, as well as the most commonly omitted items.

Key Elements of a Credit Memo:

A complete credit memo details a comprehensive picture of the borrower’s credit worthiness. Some items are common on all credit memos whether it is for a conventional or SBA loan, like the Business History, Borrower and Guarantor Summary, and Credit History. Other items may only be applicable to SBA 7(a) loans. These elements that every SBA credit memo must include are…

[ ✓ ] Established Legal Entity Names

The Credit Memo must include established legal entities as the borrowing parties, rather than entity to be formed later. Many borrowers will list the name of the entity which will be started using the SBA loan, however, applications must reference the legal names that are already on record.

[ ✓ ] Analysis of the “Credit Elsewhere Test”

The SBA requires borrowers to prove that they have not been able to secure financing through conventional means in order to qualify for an SBA 7(a) loan. This was historically a very ambiguous and hot topic item the SBA was reviewing with SOP 50 10 6 which resulted in the need for extreme, disproportionate detail to avoid processing delays, potential for denial of SBA approval, and risk to the SBA guaranty.

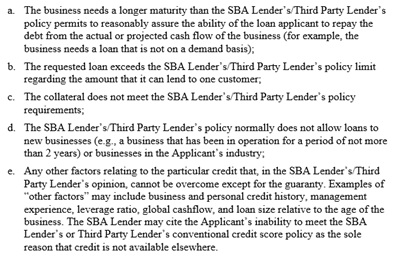

However, with the updated language included in SOP 50 10 7.1, in order satisfy the SBA’s standard, lenders must substantiate why credit is not available elsewhere from the aforementioned sources and support the certification by identifying specific weaknesses in the credit. Lenders must explicitly certify and indicate that that credit is not available elsewhere from conventional lenders, including the SBA lender, or any other non-federal, non-state, or non-local source of funds. The current SOP now provides a more detailed list of acceptable factors as seen below:

Excerpt of SOP 50 10 7.1, Section A, Ch 2: Credit Not Available Elsewhere (Full Requirements Detailed pgs. 23.-24).

Read our Credit Elsewhere Analysis blog here.

[ ✓ ] Credit Ratios

The SOP requires the following Credit Ratios also be included in the credit memo write-up, which can generally be included under the Financial Analysis:

- Current Ratio | Total Current Assets / Total Current Liabilities

- Debt to Tangible Net Worth Ratio | Total Liabilities / (Shareholders’ Equity – Intangible Asset)

- Debt Service Coverage Ratio | Net Operating Income / (Interest & Lease Payments + Principal Repayments).

- Other Ratios the Lender Considers Significant for the Specific Business and Industry

[ ✓ ] Pro-Forma Balance Sheet

The credit memo must include a pro-forma balance sheet. This ‘future looking’ balance sheet anticipates what the applicant’s condition will be the first day after the loan closes. The purpose of this item is to relay a borrower’s liquidity and debt/net worth ratios at the time of the loan’s closing.

The pro-forma balance sheet should be formatted similarly to a standard balance sheet, but it should include any assets that will be acquired with the loan, the loan itself as liability, and the borrower’s expected assets, debt, long and short-term liabilities, etc. according to their business records.

Remember, when using projections to calculate these conditions, lenders must support any assumptions made with quantifiable historical data obtained from the borrower and reasonable estimates.

[ ✓ ] Collateral

The SBA has specific collateral documentation requirements for their loan programs that may differ from internal lenders’ policies. Failure to address the SBA’s criteria in addition to internal standards can cause confusion for borrowers, frustration for lending teams, and shortfalls that could delay the loan’s timeline.

Below are some elements of the collateral section of the credit memo that are commonly omitted or incorrectly documented:

Correctly Value Borrower Assets Using the SBA’s Collateral Discount Rates

First, review that the borrower’s assets are properly valued. The following assets need to be valued based on appraisals, invoices, and/or net book values.

- Commercial Real Estate

Value all Commercial Real Estate taken as collateral based on an appraisal. Some special use property will require other appraisal requirements. For example, the Furniture, Fixtures, and Equipment (FF&E) will need to be valued separately from the property itself. If renovations will be made to the property, use an “as complete” value in the collateral analysis.

- Machinery and Equipment

There are three ways to value Machinery and Equipment. The collateral analysis can use the net book value (gross value less depreciation) from the balance sheet. The lender also has the option to obtain an equipment appraisal and use the Orderly Liquidation Value (OLV). Last, if the loan’s use of proceeds is used to purchase Machinery and Equipment, the collateral value can be based on the invoice or bill of sale. Any equipment with a value of $5,000 or more will need to list the serial number or other identifying information.

- Furniture and Fixtures

Value furniture and fixtures based on the net book value or by the invoice amount if the items are purchased with the loan proceeds.

- Account Receivable and Inventory

The values of account receivable and inventory are based on the net book value.

After properly valuing the borrower’s assets, use the SBA’s collateral discount rates in the collateral calculation. Many lenders will mistakenly use their institution’s own internal rates for collateral calculations instead of those required by the SBA. It is acceptable to list lender calculations for internal use, but the collateral must also be calculated using SBA Discount Rates, too.

The SBA uses the following discount rates for the collateral analysis:

Detail Any Vehicles That Will Be Purchased with the SBA Loan

The collateral analysis needs to detail exactly which vehicles are being taken as collateral and their value. In addition to vehicles the borrower currently owns, the collateral analysis must include any other vehicles that the borrower will purchase with their SBA loan that the lender will take a lien on.

When vehicles will be purchased with an SBA loan and be taken as collateral on the SBA loan, the bank must be added as a lien holder and the borrower as a titleholder, if applicable. Failing to account for the extra costs incurred to make the bank a lien holder could leave the loan short on closing costs and cause frustration for borrowers if they are unprepared to bring more money to closing.

Plan ahead whenever possible to factor in the time and resources needed to perfect the title for vehicles purchased with a borrower’s SBA loan in order to properly detail them as collateral on the credit memo.

List Additional Real Estate Property, When Applicable

Whenever an SBA 7a loan over $500,000 has a collateral shortfall, there is a potential for additional sources of collateral to be required. Most commonly, the SBA will require any additional real estate property that has 25% or more available equity be added to the collateral pool.

Include Life Insurance, If Required per Internal Policy

Instead of addressing a collateral shortfall with an assignment of life insurance after all collateral has been taken, the SOP requirement is now for lenders to follow their internal policy for similarly-sized, non-SBA guaranteed commercial loans. When required, the Lender must obtain a collateral assignment identifying the Lender as assignee that is acknowledged by the Home Office of the Insurer. It is important to make sure you review your internal policy on when life insurance would be required to secure a commercial loan and the amount needed. If life insurance is not required it should be noted in the credit memo that the lender is following their internal policy and wouldn’t require insurance for similarly-sized non-SBA guaranteed commercial loans.

[ ✓ ] Source of Equity Injection Into Project (If Equity Injection Is Applicable)

The Credit Memo should discuss the specific source the equity injection will or has come from, if any of the injection has already been put into the project at the time of the Credit Memo approval. The injection source should be clearly labeled. It is often formatted as a short sentence or two.

Note, the credit memo alone does not satisfy the SBA’s total requirements for equity injection documentation. The source of equity injection as well as the documentation requirements have drastically changed per SOP 50 10 7.1 so it’s important for lenders understand how to best address this topic. Read our Guide to Properly Documenting Equity Injections here.

[ ✓ ] Justification for Debt Refinance (If Applicable)

Any time that a debt is being refinanced via SBA 7(a), the Credit Memo needs to satisfy at least one of the SOP requirements for a debt to be eligible for refinancing: SOP 50 10 7.1, Section A, Ch 1: STANDARD 7(A) LOANS (LOANS GREATER THAN $500,000) (Full Requirements Detailed pgs. 93-96).

While there are several options on what debt qualifies to be refinanced, the main ones we see are either for a debt with a balloon payment, credit cards, debt with a maturity that wasn’t appropriate for the purpose of the financing, and or showing that refinancing the debt(s) will result in a cash flow saving of at least 10%, per the SBA’s requirement. In previous SOP’s the SBA has not allowed for the 10% cash flow savings to be the sole justification for the refinance so this was a major change.

Lenders may document the requirements for debt refinancing on the credit memo with an addendum that details the existing loan terms, proposed loan terms, and/or a written reasoning on how the cash flow of the business will be impacted by refinancing debt. If presenting this information narratively instead of in a table, be sure to include specific numbers in the justification.

For example, if an equipment lender provided a loan on a 3-year term, this would likely be eligible to refinance via SBA 7(a) because the starting term for equipment in the SBA 7(a) program is 10 years and 3 years would likely be less than the useful life of the equipment. A table comparing the monthly payments required for the 3-year term compared to the 10-year term would both satisfy the original maturity not being appropriate for the purpose of the financing as well as provide a cash flow savings of 10% to the business which would satisfy the requirements.

[ ✓ ] Review of Projections and Assumptions (If Applicable)

If a loan is being underwritten based on projections, lenders should critically review and document the assumptions that are used to support the projections. The SBA holds the right to decline deals if the assumptions are unreasonable or not concrete enough.

The Projections and Assumptions section often takes the shape of written reasoning in the Financial Analysis. Be sure to quantify these statements. It’s not enough to talk about the increasing strength or likelihood of the industry’s success. You must substantiate all projections and assumptions with historical data, reasonable estimates, and specific numbers.

When your SBA credit memo does not contain all the necessary elements, your institution runs the risk of significant loan delays or file audit issues at best, and loan guaranty repair or denial at worst.

Putting together a credit memo that tells a complete story of the borrower in addition to including the SBA specific elements helps to create a better experience for both your borrowers and loan processing team. Be sure to include the key elements listed in this article to write comprehensive credit memos and streamline the review and finalization of your SBA loans.

Stay up to date on the latest news and tips for SBA lenders. Subscribe to the Windsor Advantage Newsletter using the form below.

About Windsor Advantage

Windsor Advantage provides banks, credit unions and CDFIs with a comprehensive outsourced SBA 7(a) and USDA lending platform.

Since 2010, Windsor has processed more than $2.8 billion in government guaranteed loans and currently services a portfolio in excess of $2 billion (as of December 31, 2021) for over 100 lender clients nationwide. With more than 150 years of cumulative SBA lending experience, cutting edge technology, rigid controls and consistent processes, Windsor is uniquely qualified to assist any size lender with implementing a thoughtful and profitable government guaranteed lending initiative.

The Company is headquartered in Chicago, IL with offices in Indianapolis, IN and Charleston, SC.