By Alex Stuart, Quality Control and Project Manager, Windsor Advantage

What lenders need to know about the SBA’s renewed focus on the credit elsewhere analysis, and how to write more efficient analyses for the SBA loan approval process.

The credit elsewhere analysis is a required component of the SBA 7(a) loan credit memo and must pass the SBA’s standards to prevent timeline delays in obtaining SBA approval, avoid the possibility of SBA declining the application due to inadequate credit elsewhere analysis, or risking repair/denial of the loan guarantee.

This article explains the SBA’s current viewpoint on the credit elsewhere analysis and provides best practices for lenders in preparing credit memos with analyses that are more likely to gain SBA approval.

Purpose of the Credit Elsewhere Analysis for SBA Loan Credit Memos

The SBA’s credit elsewhere analysis requirement is intended to satisfy one of SBA’s primarily eligibility concepts for government supported programs based on access to funding through non-government guaranteed channels.

Full Requirements Detailed pgs. 23.-24.

Essentially, the analysis needs to confirm that all other possible sources of funding have been confirmed to be unavailable, justifying the need to obtain SBA-guaranteed financing.

Current State of the SBA: Amended Credit Elsewhere Analysis Requirements

With the introduction of SOP 50 10 7.1, the SBA has amended the makeup of the credit elsewhere analysis and the related requirements. Lenders previously were left with complex, ambiguous requirements regarding the credit elsewhere test that resulted in the need for extreme, disproportionate detail to avoid processing delays, potential for denial of SBA approval, and risk to the SBA guaranty. Conversely, the current SOP has made the credit elsewhere analysis clearer than its predecessor, opening the door for enhanced efficiency in both the underwriting processes and SBA approval reviews. The details of what must be included in the analysis are provided below.

It is necessary to point out a common misconception in the current marketplace. While the current SOP has made the requirements clearer and more concise, the eligibility criterion of applicants largely remains the same and it remains best practice to provide a more detailed analysis of specific factors and reasonable justifications of a borrower’s inability to obtain non-federally guaranteed business financing support when necessary.

Economic factors have prompted lenders to suggest the SBA 7(a) program to a different type of borrower than what we have observed historically. Additionally, while credit elsewhere requirements have been clarified relative to past requirements, the SBA now places a larger onus on the lender to conduct an accurate and comprehensive analysis of a prospective borrower’s inability to obtain non-SBA financing.

These evolving and interlinked factors are discussed in more detail below:

Economic Environment

Debt has become more expensive for borrowers as rates have yet to drop to prepandemic levels, and the volatility of recent years continues to raise the concerns of credit risk teams. More lenders are pushing borrowers to leverage the SBA’s programs, which typically provide eligible loan maturities exceeding conventional lending maximums. Given the higher cost of borrowing in the current environment, the longer loan maturities allow debt service to feasibly be at a more appropriate level.

A New SBA 7(a) Applicant

Many lenders have adjusted their credit policies over the course of the ongoing rising interest rate environment. As a result, an applicant that may have qualified for a conventional loan might not meet new/updated lender credit policies. Our teams have observed higher levels of asset-heavy SBA loan program applicants. Without a comprehensive analysis of their available liquidity, including marketable securities but excluding assets held in retirement accounts, the applicant may appear on paper to be eligible for financing elsewhere based on SOP credit elsewhere analysis requirements.

Added Lender Analysis Responsibility

The SBA has taken a big step forward by modernizing credit elsewhere requirements in the current SOP. However, an effect of this is that the SOP states that the lenders certification will be relied upon so long as the rationale includes one more of reasons from SBA’s list of acceptable factors. While the factors are often legitimate reasons as to why the lender needs the SBA guaranty to provide the financing, the certification that the applicant cannot obtain financing from any other source is often overlooked. The new program requirements may be streamlined, but the onus now falls on lenders to ensure that this certification has been completed in a thoughtful manner rather than simply “checking a box.”

What to Include in The SBA Credit Elsewhere Analysis on SBA Loan Credit Memos

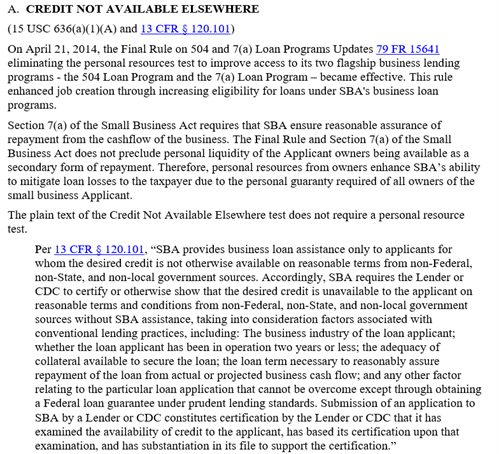

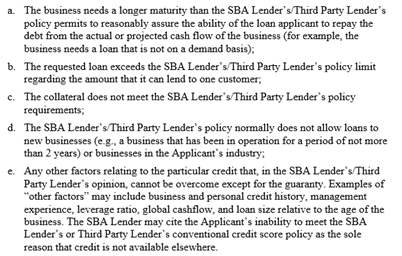

To satisfy the SBA’s standard, lenders must explicitly certify and indicate that that credit is not available elsewhere from conventional lenders, including the SBA lender, or any other non-federal, non-state, or non-local source of funds. The analysis must substantiate why credit is not available elsewhere from the aforementioned sources and support the certification by identifying specific weaknesses in the credit. The current SOP now provides a more detailed list of acceptable factors as seen below:

Excerpt of SOP 50 10 7.1, Section A, Ch 2: Credit Not Available Elsewhere (pg. 24)

Full Requirements Detailed pgs. 23.-24.

One notable difference that readers may observe is the absence of liquidity of the applicant itself, 20%+ owners, and their spouses/minor children in the analysis requirements. The SBA has removed the need to evaluate liquidity as part of the credit elsewhere analysis, which has historically been the most common cause of issues and complexity in the analysis.

While this is a huge improvement, understanding the importance of the SBA’s expectation for lenders to take more responsibility in the credit elsewhere analysis by providing their certification and supporting factors cannot be overstated. Lender certifications will be scrutinized in liquidation scenarios when applicable and every credit memo should have a credit elsewhere analysis with a level of detail appropriate to the situation of the applicant’s ability to obtain financing.

These recommendations are in accordance with the SBA’s most recent guidelines for credit elsewhere documentation as seen in SOP 50 10 7.1, which went into effect on November 15th, 2023. Download the full document here:

The Credit Elsewhere Analysis in 2024: On the Line for Lenders

An incomplete or incorrect credit elsewhere analysis significantly delays the loan approval process. This could also lead to repair or denial of the loan guarantee, inefficient closing timelines, and poor borrower/lender experience.

However, lenders that can consistently master the credit elsewhere analysis will:

- Streamline their loan underwriting and approval process

- Reduced risk of repair/denial

- Improve the borrower experience

- Implement more reliable processes and more efficiently manage customer expectations

By following the best practices outlined above, your lending team may reduce friction for all entities involved in SBA loan approval, maximizing efficiency while reducing risk and preparing for increased loan volumes in 2024.

Questions about best practices for the credit elsewhere analysis? Contact our SBA Loan Eligibility team using the form below.

About Windsor Advantage

Windsor Advantage provides banks, credit unions and CDFIs with a comprehensive outsourced SBA 7(a) and USDA lending platform.

Since 2010, Windsor has processed more than $2.8 billion in government guaranteed loans and currently services a portfolio in excess of $2 billion (as of December 31, 2021) for over 100 lender clients nationwide. With more than 150 years of cumulative SBA lending experience, cutting edge technology, rigid controls and consistent processes, Windsor is uniquely qualified to assist any size lender with implementing a thoughtful and profitable government guaranteed lending initiative.

The Company is headquartered in Chicago, IL with offices in Indianapolis, IN and Charleston, SC.