by Ethan Zallik, Director – Loan Originations & Processing

This article explains the SBA SOP 2023 changes to equity injection verification for SBA loans, and provides best practices for further developing an internal equity injection policy for SBA lending in 2024.

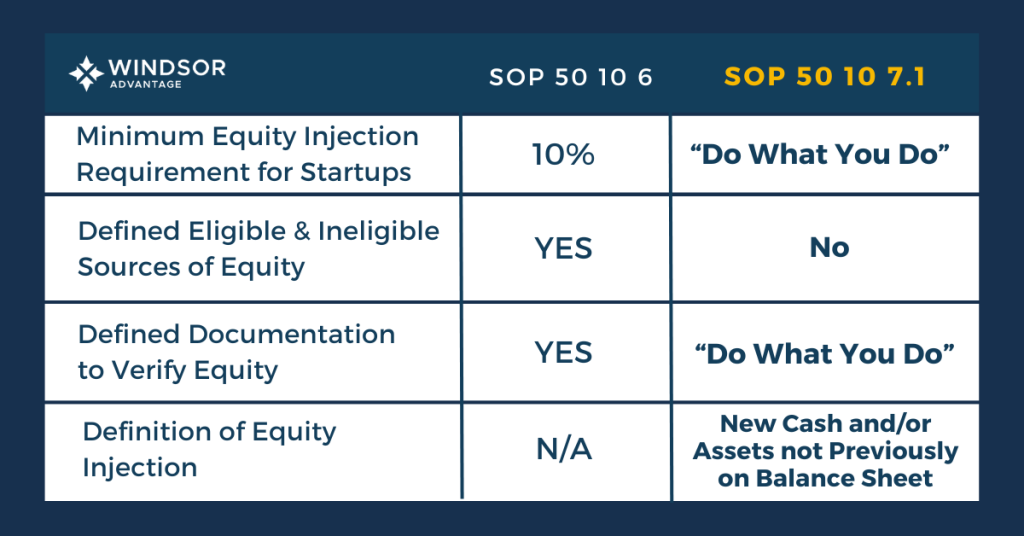

SOP 50 10 6 provided clear guidance on eligible versus ineligible sources of equity, and included very strict minimum requirements necessary to document equity injection to preserve the SBA guaranty. It also provided that borrowers must inject a minimum of 10% of the total project cost for loans for startups

SOP 50 10 7.1 has removed all such guidance on equity injection, and lenders are now expected to follow their internal policies and procedures for similarly-sized, non-SBA guaranteed commercial loans (“do what you do”). SOP 50 10 7.1 has also added a definition of equity injection that was not in SOP 50 10 6.

See below for a summary of the major changes for Equity Injection from SOP 50 10 6 to SOP 50 10 7.1:

A full summary sheet of the SBA loan equity injection requirements stated in SOP 50 10 6 is available for download here.

Below is a summary of the latest guidance for equity injection requirements outlined in SOP 50 10 7.1, currently in effect for all SBA lenders:

At a Glance: Equity Injection Requirements from SOP 50 10 7.1

Equity Injection Definition for SBA Loans

Minimum Required Equity Injection for Startups

Source and Verification of Equity Injection

If the Lender or SBA requires an equity injection, the Lender must use the same processes to verify the equity injection as it uses for its similarly-sized, non-SBA guaranteed commercial loans.

If a Lender or SBA requires an equity injection and, as part of its standard processes for its similarly-sized, non-SBA guaranteed commercial loans, the Lender verifies the equity injection, it must do so for its SBA loan.

What is an Equity Injection for SBA Loans, according to SOP 50 10 7.1?

The previous SOP did not define the term “equity injection” for SBA loans, however, the latest SOP provides a clear definition for lenders and borrowers.

Equity Injection refers to new cash and/or assets not previously on the balance sheet, according to the SBA SOP for 2024.

Do What You Do: Understanding the Underwriting Standard for SBA Lenders

We explained the new standard for lender-determined SBA loan requirements in our recent blog, “Do What You Do”: Adapting to the 2023 SBA SOP Changes. In addition to other SBA loan underwriting requirements, this policy now applies to Equity Injection requirements in the following ways:

- Equity Injection Requirements for Startups

- Documentation to Properly Verify Equity within the Lenders Loan File.

Standard Recommended Equity Injection Requirements for Windsor Advantage Clients (The Minimum for SBA Loan Underwriting)

Windsor Advantage will, at a minimum, always collect the following documentation to verify (a) that the minimum required equity injection has been spent to ensure project completion and (b) the use of the equity injection to properly allocate the sources and uses.

- Invoice, receipt, or other documentation that sufficiently identifies the amount and type of expense.

- Check, wire confirmation or banking details that verify that the expense has been paid.

Additionally, we recommend that lenders analyze their internal policy to ensure the existence of a well-defined internal standard for underwriting SBA loans. The 2023 SBA SOP changes creates an opportunity for all lenders to document required injection into the project as they would for similarly sized non-SBA loans.

Below are a few key aspects of an equity injection policy ton consider for SBA loan underwriting.

Best Practices: How to Define an Internal Equity Injection Policy for SBA Loan Underwriting

Walk through the following questionnaire to make sure you are thinking through scenarios that your institution will/won’t accept for equity verification if you do not have a written policy on it.

1. Does your lending institution have existing equity injection verification policies and procedures in place for conventional commercial loans?

- If yes, stop here. Apply these policies to your SBA loan underwriting standards. Send these policies to your lender service provider and/or underwriting team.

- If no, continue the questionnaire.

2. Does your institution find the above ‘minimum requirements’ sufficient to verify equity injection?

- If yes, stop here.

- If no, review SOP 50 10 6 processes and procedures.

If your institution will use the processes and procedures defined in the SOP 50 10 6, stop here.

If not, and if there is no current policy on verifying equity, make sure to include extreme detail in the lenders credit memo with how you plan to prudently verify the equity injection and continue the questionnaire.

3. Which bank statements will be required by your institution…

Your institution may require bank statements from any combination of the below:

- Borrowers

- Guarantors

- Affiliates

- Non-guarantor owners

- Investors

- Giftors

- Bank statements are not required to verify equity injection

And what is the lookback period from date of withdrawal on bank statements? (select one):

- None

- 30 Days

- 60 Days

- Other (define)

4. How will you address abnormal deposits?

a. Will abnormal deposits require sourcing if identified in the bank statements supplied?

- Yes

- Yes, but only if the deposit is above $___.

- Yes, but only if the deposit was needed to make the injection payment.

- No

b. If Yes, sourcing of abnormal deposits INTO the following parties’ accounts will be required (select all that apply)

- Borrowers

- Guarantors

- Affiliates

- Non-guarantor owners

- Investors

- Giftors

c. The following additional documents will be required, if applicable, based on the source of abnormal deposits (select all that apply)

- Check/Wire Confirmation

- Gift letter

- Distribution Letter (Funds from Affiliated/Associated Entity)

- Resolution Approving Distribution (Funds from Affiliated/Associated Entity)

- Purchase Agreement/Bill of Sale (Sale of Asset)

- HUD/Settlement Statement (Sale of Asset)

- Promissory Note with Repayment Terms (Loan)

- Paystub (Bonus or Other Irregular Payroll Deposit)

d. Will outside source of income (i.e. not cashflow generated by the

borrowing business or salary from the borrowing business) be required for repayment of any personal loan to owner?

- Yes

- No

e. Will loans to borrowing businesses be required to be on full standby (i.e. no payments of principal and/or interest) for the life of the SBA loan?

- Yes

- No

5. What are your requirements for Credit Cards?

a. Are Credit card accounts required to be paid down by a checking account for expenses to be considered equity?

- Yes

- No

If Yes, Windsor Advantage recommends collecting the following documentation:

- Credit card statement showing expense being paid.

- Credit card statement showing account being paid down by at least the amount of the expense(s).

- Bank statements to verify the credit card being paid down in accordance with the requirements selected above.

6. How does your institution define a ‘Startup’ for the purpose of SBA loan underwriting?

Per previous guidance, a ‘startup’ was typically defined as

a business in operation less than 1 year.

- Decide if your institution agrees with the above definition of a startup.

- Decide if your institution will continue to use the previous standard equity injection requirement for startups of a minimum of 10% of the total project cost.

- If no, write a new requirement.

Adapting to the New SBA Equity Injection Standards for SBA Lenders

We recommend regularly reviewing this policy with your SBA underwriting team, and as new versions of the SOP are released.

Many borrowers and lenders found SBA’s old equity verification requirements to be too documentation heavy, intrusive, and unnecessary. Following your institution’s internal policies and procedures for documenting and verifying equity injection may provide a great opportunity to streamline the equity verification process. If your institution’s internal policies and procedures require less than what was required under previous SOP’s, the equity verification process would be less burdensome for borrowers in an already burdensome and documentation-heavy SBA closing process.

Should your institution need further assistance creating internal standards for SBA Loan Underwriting and Equity Injection, our Underwriting team is here to help. Please reach out regarding options for utilizing Windsor Advantage as your dedicated SBA lender service provider using the form below.

Learn More: Working with Windsor Advantage

Thank you for your interest in working with Windsor Advantage, the nation’s leading SBA lender service provider. Please complete the form below to contact our SBA Underwriting team.

"*" indicates required fields