As part of the Coronavirus Aid Relief and Economic Security (“CARES”) Act passed last March, the SBA’s Paycheck Protection Program (“PPP”) helped get funds into the hands of more than 5 million businesses in dire need of a lifeline in the midst of the COVID-19 crisis. With the pandemic continuing to surge heading into 2021, the Consolidated Appropriations Act released in late December incorporated additional economic stimulus provisions as a follow-up to the CARES Act.

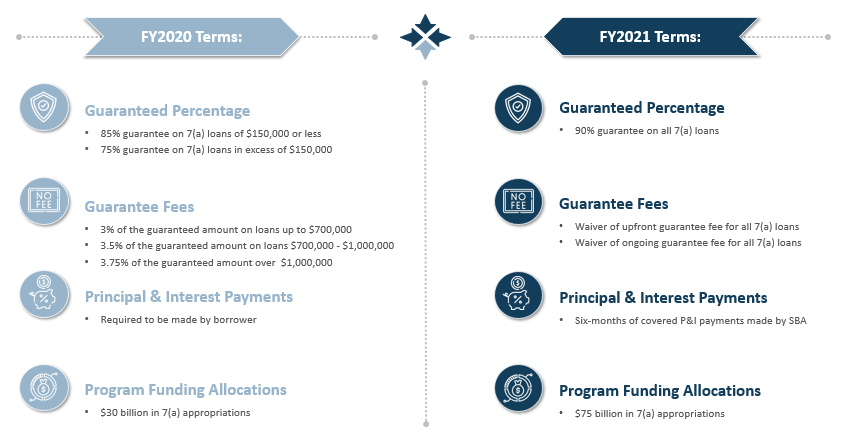

Perhaps the most pertinent part of this new legislation for financial institutions includes mandates surrounding the SBA’s flagship 7(a) Loan Program. The dollar volume authorized through the Program has grown an average 8% each year over the last decade and it’s expected to grow even more in FY2021 given these updates provide incentives to both lenders and borrowers for program participation. These changes include:

With a 90% guarantee on most transactions, no guarantee fees, three-months of covered P&I payments and nearly triple the allocation of funds available, financial institutions have a significant opportunity to increase profitability, mitigate risk and garner new relationships through SBA lending.

Here are 9 ways lending institutions will benefit from SBA lending as a direct result of each of these major policy changes to the SBA 7(a) Loan Program.

Update #1: Increased Guaranteed Percentage

There will be a 90% guarantee on 7(a) loans approved starting on February 15 through September 30, 2021, up to a maximum guaranteed dollar amount of $3,750,000 per transaction. Compare this increase to the former 85% guarantee on 7(a) loans of $150,000 or less and the 75% guarantee on 7(a) loans over $150,000 and lenders have a great opportunity to reduce risk while increasing profitability.

Lender Benefits:

1. Less Risk Per Dollar – Lenders will be accepting less risk per dollar with a higher guaranteed portion from the government. This is expected to have a major impact considering the average 7(a) loan size in FY2020 was $533,075, meaning the average loan in FY2021 is expected to have an average increased guaranteed percentage of 15% (i.e. 75% up to 90%).

2. Lower Reserve Requirements – Reserve requirements are currently set at zero in response to the COVID-19 pandemic. This is helpful in the short term, however, when these requirements are inevitably reimplemented, lenders will need to rely on the historical guidance that does not require reserves to be held against loans with a Federal guarantee. The lower unguaranteed portions (approx. 10%) will result in lower reserve requirements and lower cost of funds for lenders, ultimately yielding increased profitability.

3. Higher Net Interest Margins – With a lower cost of funds as a result of higher guaranteed portions and lower unguaranteed portions, lenders are able to take advantage of higher net interest margins. In addition, SBA loans generally carry higher interest rates than conventional paper which also adds to a higher net interest margin calculation.

Update #2: Waiver of Guarantee Fees

Guarantee fees made to the SBA have been completely waived on any new loans approved through the 7(a) Program between February 15 and September 30, 2021. This includes the up-front guarantee paid by the borrower (based on a percentage of the guaranteed portion) and the ongoing servicing fee paid by the lender (based on a percentage of the guaranteed balance for the life of the loan). As a result, costs have become much more competitive with that of traditional commercial financing.

Lender Benefits:

4. Reduced Borrower Costs – The upfront guarantee fee has historically been one of the biggest complaints among borrowers with the 7(a) Program. This fee waiver should be considerably attractive for new borrowers interested in a 7(a) loan.

5. Reduced Lender Costs – Waiving the ongoing guarantee fee on 7(a) loans for lenders will have a positive effect on the profitability of the lending institution long-term. The lender will save approximately 0.55% on the ongoing guarantee fee for the life of the loan. This will add to the increased net interest margin on each deal as well.

Update #3: Covered Principal & Interest Payments

Section 1112 of the Consolidated Appropriations Act requires the SBA to make payments on new and certain existing SBA loans. For borrowers with a loan approved between February 15 and September 30, 2021, principal and interest payment subsidies are now available for a three-month period beginning with the first payment due after the loan has been moved into a regular servicing status.

Lender Benefits:

6. Mitigate Default Risk – These covered subsidies can help reduce the risk of defaults of the existing portfolio and subsequently ease the minds of lenders. Payments made by the SBA may only begin once the loan has been fully disbursed. However, lenders are encouraged to be flexible when working with borrowers to develop a customized payment plan that supports long-term success based on the situation.

7. Stimulate Local Economies – Supporting existing local small businesses is essential for community banks and credit unions. So many independently owned and neighborhood small businesses have been forced to drastically alter business models just to survive during the pandemic. Covered loan payments will not only provide the financial flexibility necessary to ensure employees at these businesses are retained, but they will also help stimulate overall business activity within local economies.

8. Attract New Borrowers – Three-months of covered principal and interest payments for borrowers provides an opportunity for lenders to attract new borrowers to the Program that are interested in scaling their operation faster. The previously mentioned waiver of the upfront guarantee fee can also certainly help pique potential borrower interest.

Update #4: Increased Overall Appropriations

There will be $75 billion in funds available for lenders to authorize in FY2021 compared to roughly $30 billion last year. With several new and encouraging guidelines, volume levels are expected to reach all-time highs. In addition, it’s likely that some of the institutions that engaged in PPP lending (5,460 according to the latest data as of January 31, 2021) will look to gain 7(a) Program familiarity in FY2021. For reference, only 1,578 lenders authorized at least one loan through the 7(a) Program in FY2020, which represents only 28% of those institutions that participated in the Paycheck Protection Program.

Lender Benefit:

9. Increased Allocation of Funds – As the appetite among borrowers for SBA products continues to grow, we anticipate more and more institutions will also be interested in expanding their SBA lending programs to handle the increased demand. With an increase in expected lender participation, the increase in appropriations will provide a cushion to ensure funds do not run dry and all interested lenders are able to participate.

The upcoming year is expected to be another record year for traditional SBA lending and program participation given recent updates to legislation under the CARES Act. That said, there are number of considerations lenders should keep in mind, such as increased compliance scrutiny and how to coach borrowers in preparing for when three-months of covered principal and interest payments are no longer available. Be on the lookout for future articles addressing best-practices on how to handle these topics.

Standing up an SBA department is challenging but leaning on a Lender Service Provider (LSP) can ensure a thoughtful, comprehensive, and compliant approach to scaling SBA lending programs. If your institution has been on the fence about SBA lending in the past and has a new-found interest in getting involved, please contact [email protected] to learn more.

About Windsor Advantage, LLC

Windsor Advantage provides banks, credit unions and CDFIs with a comprehensive outsourced SBA 7(a) and USDA lending platform.

Since 2010, Windsor has processed more than $2.8 billion in government guaranteed loans and currently services a portfolio in excess of $1.8 billion (as of December 31, 2020) for over 100 lender clients nationwide. With more than 150 years of cumulative SBA lending experience, cutting edge technology, rigid controls and consistent processes, Windsor is uniquely qualified to assist any size lender with implementing a thoughtful and profitable government guaranteed lending initiative.

The Company is headquartered in Chicago, IL with offices in Indianapolis, IN and Charleston, SC. For more information, call (317) 602.6648 or visit www.windsoradvantage.com.

About the Author: James Tibert is responsible for Windsor’s marketing and sales operations functions. Prior to joining Windsor, James worked for a Meridian Loan Partners, a FinTech platform (Acquired by Windsor in January of 2020) specializing in SBA loan intake and processing.